Living in Southeast Ohio means dealing with high waters. Be prepared, and don’t let your investment get washed away with Athens Ohio Flood Insurance from O’Nail Hartman.

Who Needs Flood Insurance?

If you live in Athens and think you may need flood insurance, you probably do. If you are applying for a mortgage, through one of the local lenders such as Hocking Valley Bank or the Ohio University Credit Union, depending on the location, they will often require proof of flood insurance to approve a new mortgage in Athens County.

According to an Athens NEWS article from March of 2015 (March is a problematic month for high waters in Athens:)

“In July 2012, the U.S. Congress passed the Biggert-Waters Flood Insurance Reform Act of 2012 intending to render the Federal Emergency Management Agency’s disaster relief program solvent. A few months later, massively destructive Hurricane Sandy slammed into the East Coast. As a result of that storm and others, the costs and consequences of flooding, according to FEMA, are increasing dramatically. The program is currently $24 billion in debt.”

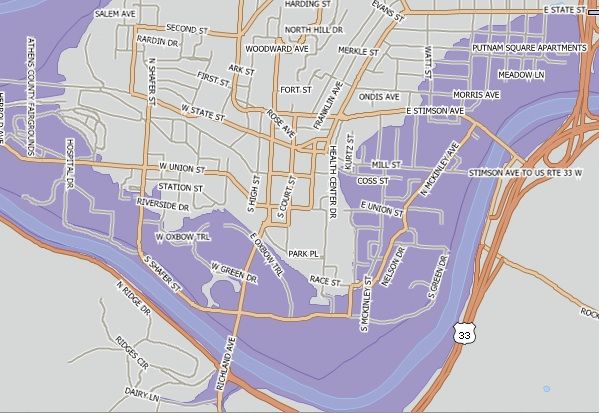

The purple sections in this map denote the floodplain in the city of Athens.

Source: Athens County Auditor’s Office

What Does It Cover?

Athens Ohio Flood Insurance through O’Nail Hartman Insurance will cover loss of home and contents due to flooding and water damage. In some cases it will also pay for lost wages and legal fees, and typically does include replacement.

How Much Does It Cost?

It varies depending on your exposure to risk, and the amount of money you want to protect yourself from loss. Typical flood insurance policies can run around $80 per month.

How can I Get Athens Ohio Flood Insurance?

Flood Insurance is available through the Federal Government (FEMA) but we also are able to assist you with personal guidance and assistance if you are in need of Athens Ohio Flood Insurance. Simply Contact Us at your convenience.

The aforementioned Athens NEWS article also continues to talk about the unique problem some “East Side” residents (of Athens) have dealing with flood insurance, especially when buying or selling a home. The article (by David DeWitt) quotes local real estate agent Liza Maule:

“When they get prequalified for a mortgage, the cost of insurance on the house is part of their debt-to-income ratio, on the debt side, of course,” she explained. “So if they have to pay $100 per month in flood insurance, that decreases the amount of house you can buy because of those ratios.”

Flood Scenarios: The Good, The Bad and The Ugly

When I talk to fellow homeowners about flood insurance, they get a bit skeptical about it. Some argue that they don’t need it because they don’t live near the ocean or have hurricanes in their area. The harsh fact is that water damage can be caused by many other factors than just rising sea levels or hurricanes. The good thing is that at Logan Ohio Flood Insurance, we got you covered! The bad is that… small problems could turn into worse. For example, winter temperatures may suddenly drop and cause your pipes to burst which then flood your entire basement! The Ugly, not having proper flood insurance!

Is Flood Insurance Through O’Nail Hartman Available Elsewhere?

Yes, we offer our Flood Insurance policies to all our areas of service, so if you are in need of Logan Ohio Flood Insurance, we can also assist you in Hocking County Ohio as well as Athens.